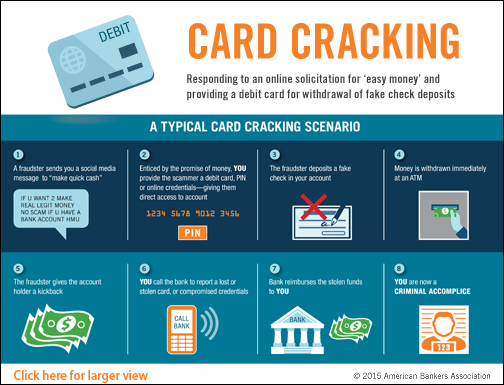

Card cracking scams are on the rise, and they have very serious repercussions. The scams tend to target young adults in particular, such as newly enlisted military personnel, students and single parents. These people are enlisted to commit fraud against their bank. Usually, con artists target their victims using social media, and through elaborate ploys, convince them to share information about their bank accounts. In return, they are promised some sort of kickback. The kickback tends to be a counterfeit check that is deposited remotely, promising that the consumer will be allowed to keep a certain percentage of the amount that is deposited. Banks take several days to find out that the check is counterfeit. By this time, the con artist will have removed the money (usually all of it, including the percentage promised to the victim), and the victims are left with a debt to their bank.

In a different version of the scam, fraudsters convince their victims to part with their debit card and PIN number, telling them that they should report the card stolen. The story is that if they report it as stolen, any withdrawals are covered under Reg E, meaning they will get their money back. The fraudster cleans out the bank account and it is only afterwards that the victims find out that they will not be able to recover their money at all.

A National Problem

Card cracking is something that affects everybody all over the country. However, it is currently most common in Illinois, Washington, Ohio and Georgia. Some notable news reports include:

- Two men from Newport News found guilty of fraud and ID theft

- A woman from Portage sentenced for cracking cards

- A Chicago rapper and 28 others arrested for cracking cards

The Chicago case made international news. The rapper and his 28 co-conspirators stole about $6.5 million through their scheme. This is the biggest case to date.

ABA Survey

The American Bankers Association (ABA) conducted a study between July and August 2014. In it, they found that those responding to the survey had experienced a total of over $18 million in successful and unsuccessful card cracking attempts since January 2013. Actual losses came to over $6 million, and this was across 2,600 different cases of card cracking.

It was also found that the majority of victims who fall for this scam do not realize that they are actually committing a crime. The truth is, if convicted, they could face as much as 30 years in prison just for taking part in it. Being charged as an accomplice to a crime is a very serious offense. Besides facing fines, a possible jail term and a criminal record, people also stand to lose all of their savings, as well as falling into debt because others steal money from their account or make unauthorized purchases. The big problem is that the victim actually consented to the scammers having access to their financial accounts. As a result, it is almost impossible to demonstrate that any purchase or withdrawal was not, in fact, authorized. If the victims do claim that their cards were stolen or lost before any withdrawals or purchases, the bank is responsible and accountable for any money that was looted or lost. However, scammers are incredibly clever in this particular con, so they will generally make sure all of the money has been removed before someone reports the card stolen.

Banks obviously have to protect themselves as well. As such, they must raise their own internal awareness of the fact that this fraud is now very commonplace. As such, they are working at methods of better detecting and monitoring this type of fraud. Many banks are currently developing specific response plans that aim to address this issue. Not just that, however, but they must think of ways to provide education to their clients so that they learn to understand that this is a scam and that they will be out of pocket and in potential legal difficulties if they fall for it. Because the scam targets young people in particular, however, this can be very difficult.

Tips to Protect Yourself

The ABA has come up with a number of tips that can help consumers to protect themselves, avoiding becoming involved in what is a serious crime. The tips are:

- To never respond to any type of online solicitation that promises ‘easy money’ can be made. A card cracking advertisement will usually show a method that makes it appear as if the actions are quick and safe, and that they allow people to earn some extra cash without having to do much. The scammers will do all they can to make the victims believe that it is legal and safe.

- To always remember that your account number and PIN number are yours and yours alone. In fact, even the bank does not know your PIN number. You should never, under any circumstances, share this information with anybody, no matter how legitimate their reasons may seem. As soon as you share your details, you leave yourself wide open to fraud and it will be very difficult to prove that you did not in fact authorize any transactions.

- You should never file a false fraud claim with any institution, including your bank. If you do, you become a co-conspirator to fraud, which is a serious crime that could land you a 30 year jail sentence. Banks now have excellent detection systems in place, which they continue to improve all the time. If a claim looks even slightly suspicious, they will investigate it very closely and it is likely that you will get caught.

- If you see any posts on social media, banners, email or anywhere else that look suspicious, you must report them straight away. Report them, at first instance, to the social media site on which you saw them posted. You should be able to do this from the post itself. You may also want to consider contacting law enforcement and filing a complaint with the Federal Trade Commission (FTC), which can be done online through an easy form or over the telephone.

Additional Resources:

- Card cracking: Not what it’s cracked up to be

- Are you susceptible to a ‘cracking card’ scam?

- Card Cracking Scam Thrives Due to the Vanity of Social Media

- Card cracking scam targeting young people

- “Card cracking” scam increasing

- Card cracking and 5 scams that fool millennials

- “Card cracking” scams are cranking up on social media

- Regulation E compliance guide

- ABA Card Cracking Scam

- FTC Complaints Assistant